I did a little Twitter poll recently and it's interesting to see that many people know what a Savings Rate is, but they don't know their own savings rate. That's a bit like know about healthy eating but not doing…

Financial freedom isn’t just about being rich. That’s one aspect but there’s so much more which simply relates to your mindset and outlook on life. Financial freedom is about having more options in life and less stress and worry about money.

Some strategies to follow to ensure financial freedom include:

Understanding the importance of cash flow and making sure that you not only survive month to month, but that you have excess at the end of the month.

Set up an emergency fund to help smooth things over when life throws curve balls at you.

Create a financial plan and keep track of your progress. You’re allowed to change it as life changes.

Make smart investments. Get a retirement savings in place, take out Unit Trusts or buy ETFs. Invest for the long run!

And finally, create passive income streams. These could be from rental properties, side-hustles or businesses that you start. It’s not easy creating a stable passive income stream but once you have it, wow, it makes a difference!

I did a little Twitter poll recently and it's interesting to see that many people know what a Savings Rate is, but they don't know their own savings rate. That's a bit like know about healthy eating but not doing…

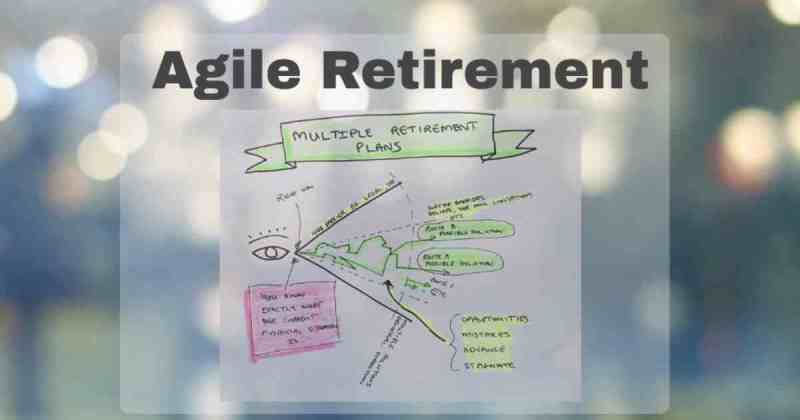

Have you ever set a financial goal which you didn't reach? You really aren't alone because we live in a world fill of uncertainty and constant change. It might be easy enough to set short term manageable goal, but how…

Today is Heritage Day in South Africa. This is a celebration of our heritage, diverse cultures, traditions, language and generally a time to remember where we came from. I thought we should spend a little time today thinking about what…

Ever wonder why people get into debt? I mean, we all know that debt is bad. But let's be honest now, the "debt system" is built in such a way that we're encouraged (forced?) to get into debt in order…

Why buy property in trust? This is a very important question as one often hears about people buying properties in a trust and that it's the "best way to invest". It may be, but it may also not be. It…

Have you heard of "Trust Fund Kids" or people saying you should buy a property in a trust? It sounds marvelous but what exactly is a trust and why would you want one? (And if you're interesting in buying a…

Welcome back to Tebogo's Story. Make time for your money and if you missed the first one on the realisation that change was needed, I'd suggest you listen to that first. Tebogo's Story (Part 1) - I need to fix…

Lifestyle creep is a real thing. It's also called lifestyle inflation and it's something to always consider at the back of your mind. If you're not sure what it is, then read on as this post is definitely for you!…

It seems weird that anyone would spend money that they don't actually have but yet it happens all the time! Have you ever justified buying something by saying "oh well, it's payday next week anyway", or even worse "I'm buying…

This week has been an interesting one as I've been reminded of my values on two occasions. Firstly, I happened to read this post from The Disruptors "Do you want it all now or are you prepared to wait" which…

Owning a place that you can call home is really awesome, but having to pay for it over 20 - 30 years is absolutely dreadful! It's like having a noose around your neck; just one mishap and bang - the bank…

"What does that even mean?" you might be wondering. Well, by "survival number" I am referring to how much you need in order to survive. And really, what's the least amount of money you can survive off if things were really…