The power of compounding interest and its beneficial outcomes for those on the fortunate side of the finance equation is a well-known one. The undesirable side would be the side that pays compound interest on debt such as a house mortgage or vehicle finance.

Financial institutions talk about money growing money – wealth exploding, coupled with a graph that tells the story of the unfortunate late starter competing with the diligent saver, racing to retirement to see who’s got the most. Spoiler alert: you’ll never beat Chris, the super-savvy investing genius, who saved 20% of all his income since his 25th birthday.

For all its overuse in neither-here-nor-there articles and poorly explained relevance, the nature of compound returns cannot be stressed enough. We’ll explain what compounding means to you and how to easily position yourself to take advantage of this colossal force of mathematics.

Compounding Interest 101

Simplistically put, a compound return is one in which a type of loan or investment accumulates interest or returns which are added to the principal (original amount of money) moving forward. Your bigger balance attracts a higher return, and so your investment grows, each subsequent period more so than the first.

This differs to a simple return, where you’re unable to ‘earn interest on the interest’. An example of a simple return is the annual return on a hypothetical bank account of say R1,000 where you are obliged to withdraw the interest every month and you cannot reinvest it. Your bank balance remains at R1,000 as returns are always paid out.

It’s not often that you’ll find investment opportunities that pay only simple returns, and likely inconceivable that you’ll ever borrow money and be charged simple interest.

Commentary on compounding often includes a reference to exponential growth. Exponential growth is growth on your investment represented as a curved line shooting skywards, as opposed to a straight line for a simple return. Each year, the ‘trajectory’ of your savings goes steeper and steeper as compounding interest takes hold.

The change in steepness of the curve is as a result of earning a bigger and bigger return every year in rand terms (even though your investment might only pay you 8% p.a.), as your investment amount for that year on which you’re able to earn a return is bigger than it was in the prior year.

Exponential growth means that even the smallest amount can become the biggest amount – if given enough time. Consider that a 10 cent investment today can grow at 8% p.a. to R480,000 – albeit in two hundred years’ time. LOL. While you’re not going to be around for two hundred years, compounding works for all time frames but definitely favours those with more time on their side.

A very good graph

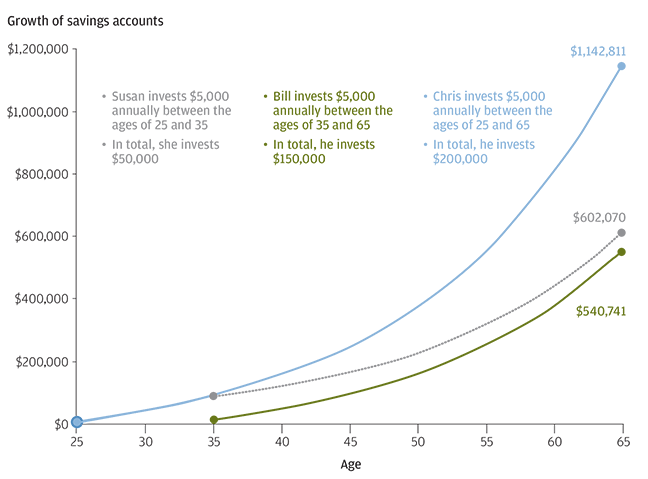

To stress just how time is in fact money when it comes to compounding interest, consider the graph below. It shows the investing behaviour of three people over a forty year period.

The graph is from a US source and shows dollars and uses typical American people. The concept is what’s important though!

Source: Retirement insights, Guide to Retirement 2014 Edition, J.P.Morgan Asset Management

Chris is the guy nobody knows but should you by chance one day meet him, he’ll leave you feeling pretty miserable about your prior financial decisions. He decided to start saving at age 25 and has consistently done so until his 65th birthday. In total he invests $200,000.

Susan, like Chris, was super-motivated to give investing a go. She also invested from age 25 but gave up after 10 years. From age 35 onward, she left her money to earn returns and no longer contributed further. Her grey line keeps up with Chris’s blue line up until age 35, after which Chris carries on investing $5,000 every year.

Lastly there is Bill. Bill was caught napping and at age 35 committed to saving $5,000 per year up until his 65th birthday, just like Chris, albeit ten years later.

Unsurprisingly, Chris is winning at finance. He did after all invest from the beginning, but why this graph is a particularly good one, is the baffling contrast between Susan and Bill.

Susan only spent ten years of her life saving (25 to 35) and stopped completely after that. Bill however, invested a total of three times * what Susan did, and for three times as long, yet his accumulated amount is less than Susan’s. In fact, it would take Bill more than twenty years to catch up with Susan.

- There is merit in the argument that $150,000 is not three times greater than $50,000 in purchasing power terms when looking at inflation. Bill wasn’t giving up three times as much as Susan had to, to reach almost 90% of her savings. Inflation and an increase in Bill’s earnings over time would have meant that it was far easier for Bill to annually forego $5,000 in his later years, than it was for Susan to do so from age 25 to 35. This is material enough for a healthy discussion – just not now. Sounds technical, but read it again!

How is that possible and what does that all mean?

If you can manage it, get Time on your side

The reason that Susan was able to get away with contributing far less than Bill did, yet end up with much more, was because she had the benefit of earning a compounding interest over a period of forty years, vs. Bill’s thirty years. During these early ten years of investing and earning a return, Susan was able to build up a much larger investment amount, which despite not being added to after age thirty five, gave her the advantage of earning continual returns on a larger balance going forward.

The benefits of having time on your side is made more evident by this example as Bill started a whole decade later than Susan. Were he to start say only five years later, the picture would look very different. But this is precisely what this exercise should impress upon you, is that time is money when it comes to compound returns.

Consistent and patient, converted to personal finance terms, really means two things:

- Invest regularly

- Don’t withdraw money from your investment

Coupled with a bit of

- Small amounts matter

Susan and Chris committed to investing regular amounts and never missed a contribution for ten years. But it was Susan’s informed efforts to start early that saw her ten year stint surpass everything that Bill could throw at personal finance for thirty years.

Susan chose never to withdraw her money, always choosing to let her annual investment returns stay invested to allow for compounding, despite never topping it up after ten years. A withdrawal of any return would have had an exponential effect on her future balance.

By committing to investing a relatively small amount for ten years (one third of Bill’s total), Susan still has more than Bill, likely when it matters most – when neither of them are earning a salary any more.

What this graph shows us is that how much you have to start investing or saving with, is not as important as starting early.

Back to the future

While none of you would likely find yourself in Chris’s shoes, or even possibly Susan’s, this would leave Bill as your best fit.

If this is so, we understand that Bill’s position is less than enviable and this generally makes people grumpy. Pointing out your future wealth lost for starting to invest later in life is hardly a feel good takeaway, but consider the future financial effects if you continue to do nothing.

Don’t see yourself as Bill, see yourself as Susan now. Bill is what you will become if you do nothing for another ten years. Susan still has the chance to get one up over Bill.

Even better, Susan becomes Chris by regularly investing, not just for ten years but right into retirement.

Remember that it should not be about you vs. the rest of the world (or Chris); it should be about you vs. what you might look like if you do more of nothing.

Some closing comments

Compounding rewards those who are patient and are happy to accept the boring proposition that consistently spending less than you earn. Investing that positive difference each month to a sound investment will generate wealth over time. These are the people who may not necessarily understand compounding interest in a mathematical sense or care for exponential returns, but they do however trust someone else enough to take their advice.

The wait is long, but it’s worth it

For compounding interest to truly shine, it takes decades. An outcome evident only in future generations is far too distant for many to consider it worth their present-day consideration and attention. This is just another example of the disconnect between your present-day and your future self.

Compounding is not something you choose to happen – you can’t. You have to wait for it to happen. That’s how it works. And this is what makes it frustrating. Responsible personal finance requires you to ignore calls to gamble on speculative ‘opportunities’ and acknowledge rather that sound and regular investing will yield you results over time.

Do what you need to do with what resources you have at your disposal, especially time, to give yourself the best possible chance of meeting your financial goals.