I’ve been tweaking my long term investment strategy for the past few months. You can follow what I have been doing since my first Easy Equities investment, up to now. And my final monthly update will be for December 2019. I’m investing in ETF’s and you can read my Easy Equities investment update for last month.

Current investment

Up to now (28 October 2019) I have invested R14,700. This is the gross amount of money I transferred to EasyEquities and even though fees have been deducted, the current balance is R14,911.79. This is a growth of R211.79 or approximately 4.2%.

Based on my standard comparison to my bank account, it would have been better to simply leave the money in my account. This of course is different from month-to-month as the ETFs perform better or worse.

We know though that ETFs are for the long-term and being the admin-freak that I am, I will keep tracking this to see how things perform going forward.

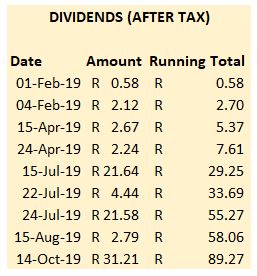

I did receive R31.21 in dividends this month which is not much, but slightly more than the previous dividends. This is the after-tax amount that was deposited into my account.

There is unfortunately no defined formula or expectation of what the dividend will be so one just gets a surprise when you see the amount.

I simply reinvest the divided as soon as it’s received so that it keeps growing my overall investment.

Long Term Investment Strategy

My investment strategy has not changed for the past 2 months. I am sticking to the following ETF’s and percentages:

- 25% Local Equities – CoreShares Sci-Beta (Smart Beta)

- 15% Local Equities – Satrix Top 40

- 10% Local Property – Satrix Property ETF

- 39% Offshore Equities – Satrix Worldwide

- 10% Offshore Property – Sygnia Global Property ETF

- 1% DCX – Crypto

To close

The monthly updates are becoming less exciting as I have settled on my strategy and am now simply sitting back and watching it grow.

Passive investing like this is the “boring way” to invest but will pay off in the long-term (20+ years).

Two more updates and then I will post as and when I see an interest.

Have you ever thought about how much you need to retire?

What’s your plan?

Please share your investment strategy with me – either on Twitter or here in the comments.