Imagine buying a house for R1 million and selling it 6 years later at R1.5 million and making a loss.

But how? This may seem confusing; surely if you sell your house for more than you paid for it you’d be making a profit?

Not so, unfortunately. I’ll show you what you need to take into consideration when calculating whether you’ll be making a profit or not.

It’s easy to get caught up in the emotion and simply look at the selling price versus the buying price and believe that you’re making money! You may in fact be selling your house at a loss.

It’s not always a loss and not everything is bad, look at the calculations though and don’t let your emotions cloud your logic.

The scenario

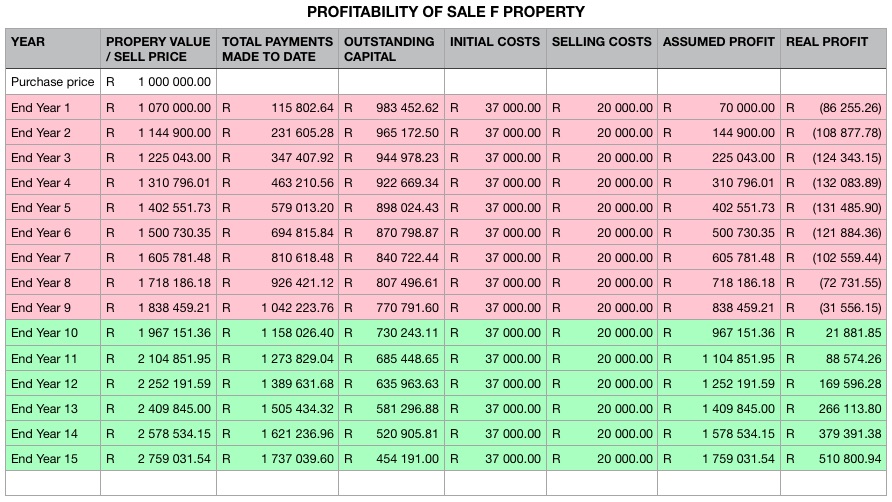

It’s inevitable that you’ll hear stories from friends or family telling you about how much money they made off the sale of their house. Let’s look at an example where Joanne bought a house 6 years ago for R1 million, and now sells it for R1,5 million (that’s around 7% growth each year).

She’s obviously excited about the half a million profit that she’s made. But let’s take a closer look….

The maths

We’ll assume a 20 year home loan at a 10% rate, and let us say that it was a 100% loan and that no deposit was paid. This means that the monthly instalments on the R1 million loan would be R9,650.22 per month. (We will completely ignore monthly charges on the loan account)

Calculation 1

If Joanne paid the standard loan instalment each month for 6 years she would have paid:

R9,650.22 x 72 = R694,815.84

But, the outstanding capital on the loan after 6 years will be R870,798.87 (this is how much she still owes the bank)

So of the R1.5 million she receives from the sale of the house, R695k is her own money that she has been paying monthly as instalments. R870k is what she owes the bank and that leaves her with a R65,000 loss!

Calculation 2

If that doesn’t quite make sense, let’s look at it this way.

Over 6 years Joanne was paying R9,650.22 per month and some of the money goes towards interest and some goes towards capital.

In fact, R565,614.71 is interest payments and only R129,201.13 is capital payment.

So over the 6 years Joanne has paid over half a million rand purely in interest!

So if you take the selling price (R1.5m) less the purchase price (R1m) less the interest payments you end up with:

R65,614.71 loss! (the same as above but this is the exact figure)

Initial Costs

Now let’s be more realistic about things and unfortunately it may be a bit depressing.

Looking at costs from 6 years ago (2013) the costs involved in purchasing the R1,000,000 house would have been:

- Transfer costs: R12,000

- Transferring attorney: R12,500

- Bond attorney: R12,500

Thus R37,000 upfront fees.

Note: These fees are based on 2013 guidelines and change almost annually! They’re based on a sliding scale of the purchase price.

There is also a bon initiation fee which is currently around R6,000. I forgot to add this into the calculations so simply mentioning it for now.

With this added knowledge, Joanne is looking at a loss of R127,000

Capital Gains Tax

Capital Gains Tax (CGT) is not applicable to your primary residence (ie the house where you live) if the gain is less than R2 million. So if Joanne lived in her property there would be no CGT applicable, but if it was an investment property which she rented out, then she would be liable to CGT.

So, assuming this is Joannes primary residence, there is zero CGT.

But, if this was an investment property which she rented out it would be different. Looking at a simple calculation which is not necessarily taking all aspects into account (find a professional to help you determine the tax implications!)

- Capital Gain R500,000

- Exclusion : R40,000

- CGT Rate: 18% of R460,000 = R82,800

That is not cool!

Selling Costs

Unless Joanne sold her house privately, she would have paid either an online site fee or an estate agent fee. Anything from R20,000 – R100,000 depending on where she sold it and how good her negotiation skills are.

This selling cost adds to her losses!

At what point would the sale result in a profit?

This all seems depressing and quite crazy! I mean buying a house for R1 million and selling it 6 years later for R1.5 million should surely be profitable! Can you really be selling your house at a loss?

So at what point would this house sale make a profit?

Assumptions:

- a 20 year loan at 10% interest

- standard instalments are paid monthly (no additional monies)

- this is a primary residence with zero CGT applicable

- property is increasing in value at 7% per year

- selling costs capped at R20,000

- initial transfer and attorney fees were R37,000 (6 years ago)

The answer is by the end of Year 10 you could potentially sell your house at a profit.

Note that this is just an example and you should try to apply the logic to your own circumstances when doing the calculations. You may have paid extra money into your loan, you may have a better interest rate and your home may have increased in value by far more than the average.

Don’t be afraid to play around with numbers and try to work things out for yourself.

The longer you own a property, the better chances you have of selling it at a profit.

Try out the free Home Loan Calculator to view your monthly installments broken down to interest and principle payments.

Renting vs buying

Now this is where things may get tricky as everyone’s situation is very different and the example may not be applicable, or it may simply be wrong for your own situation. Hear me out though and look at the logic.

We always assume that buying is better than renting as you’ll be paying for your own asset as opposed to someone else’s investment.

As you saw from the example above, selling a property after 6 years could well lead to a loss of around R121,000.

If Joanne had rented a small place at say R5,000 per month and the rental increased by 8% each year, she would have paid over R400,000 in rent for 6 years. So the loss incurred in the sale of the property is less than had she rented.

But, it’s really important to understand that the calculation may be very different if she was renting a single room at a cheap rate or whether she rented something more expensive.

Also remember that in a rental unit you’re not responsible for building insurance nor any maintenance, or rates & taxes and these could potentially add up on your own property. A damp issue could cost upward of R30,000 to fixing the gutters on your roof could be pricey too.

None of the calculations have taken maintenance into account, but it is something you could consider.

Final thoughts on selling your house

It is possible that you’re selling your house at a loss, and perhaps it makes sense due to other circumstances.

The main point of this post is to understand that the profitability on the sale of a property is not simply the selling price less the purchase price. The initial upfront fees, interest costs and selling costs all pay a major role and can easily make your “profit” disappear.

Selling your home in order to upgrade could be a very expensive process as you may make a loss on your home and then start your new property investment with further losses incurred by the initial transfer costs and attorney fees. All these things erode your overall wealth and cost you far more than many admit to believe.

As a final point, how much do you lose selling a house as is? This is very tricky to know but it’s worth consulting with an estate agent when you first think about selling. Perhaps some minor work would be to your benefit, perhaps not. It really depends on the overall state of your house.

Also see: Whether it’s better to pay off your home or invest, and why would you refinance your home loan?

What do you think?

Awesome article – we are currently looking to sell our apartment and this article was quite handy in helping me figure out if we were going to sell at a loss or not. I have a question about the “profitability of sale of property” screenshot you included. The “real profit” figure seems to be based on the sale price. I am curious as to why it isn’t based on the profit (sale price – purchase price)? Surely that’s the number that would help you determine when your property sale is profitable? Or am I thinking about this incorrectly?

Thanks and great question!

The Assumed Profit is the sell price less the buying price and

The Real Profit is the sell price less the buy price less the interest you paid less the costs

Hope that makes sense

If you pay CGT on selling your primary residence if you make +2 million profit, would it be worth not paying off your bond? Rather keep an amount owing in bond, so if you do sell, you make less than the 2 mill profit and therefor don’t incur CGT? Great articles btw!

That’s a good question but it will depend on your own circumstances. How much the bond was for, and how far into it you are. I don’t think it will make such a big difference but it’s probably a good idea to consult a property tax professional who can advise. These things are always quite different based on individual circumstances.