It’s amazing how quickly time flies and it’s been over 7 months since I started my first investment with EasyEquities. I’m investing in ETFs and this is my next update. You’ll see a change though as I was invested in the CoreShares Top 40 ETF which has now converted to what they call the CoreShares Sci-Beta ETF.

The monthly updates are not always that exciting but this month (July 2019) has two interesting aspects:

- dividends,

- and the changes to the CoreShares Top40 index.

But before we get to that, let’s take a look at my current investments.

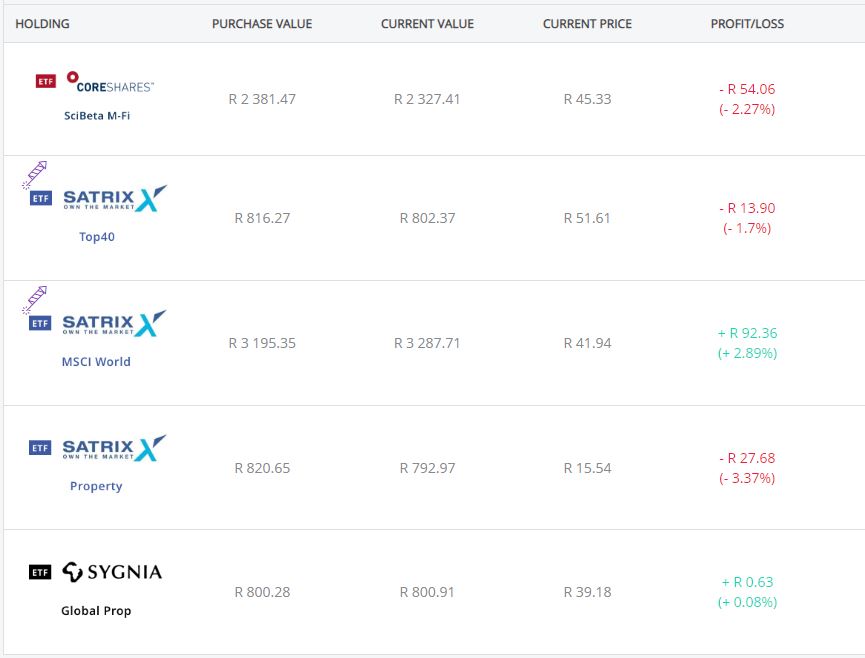

My current investments

To date I have invested a total of R7,950 into ETF’s and I currently have a balance of R8,037.38. As always, I only keep track of the lumpsum amount I invested and I don’t try to track fees or taxes as that makes life complicated. So think of it simply as the amount that I transferred from my bank account.

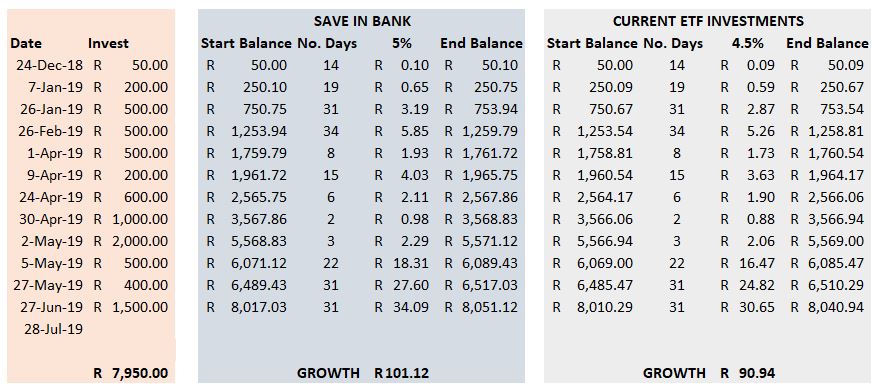

It’s been over 7 months and if I had simply deposited my money into my bank account and earned 5% interest, I would have had slightly more money. Passive investing is certainly not a “get rick quick” scheme and there will be periods where your money doesn’t grow that well. I’m tracking it though to see how it works out.

This table shows the amounts that I invested, and the number of days that it would have grown. The middle area is if it was in a bank account earning a steady 5% interest and the last columns show my actual earning (rounded up). So my average growth since starting is 4.5% or around R90.

I’m not sure how long I’ll keep tracking this growth but when starting this series I committed to at least a year which means I have a few more months left. Let’s see what happens.

Dividends

Dividends are great! Every few months you receive money which is truly passive income. You don’t have to do anything for it!

Again I don’t track taxes so these dividend figures are the net amounts that were allocated to my account. I always just reinvest them immediately but you don’ t necessarily have to do that.

This month was good and I received almost R50 in dividends. Sure, that is really nothing and won’t make any difference to my life but it’s the underlying principle that gets me excited! The money will come every few months and the more you have invested, the more you receive as dividends.

Not all ETFs pay dividends as some simply increase the value of the underlying shares. It’s tricky to find a consolidated list though of which funds do what, and when. Thankfully for us, Nerina Visser from ETF SA puts together a quarterly list showing all the ETFs and their dividend and distributions. Follow her on Twitter.

The new CoreShares Sci-Beta

Up to now I have allocated 30% of my portfolio to local equities, specifically in the CoreShares Equally Weighted Top 40 Fund. What this WAS is that your investment was equally distributed between the Top 40 companies as listed on the JSE. That’s a nice simple diversified portfolio.

CoreShares has however changed the underlying index to what is now called the Scientific Beta Multi-Factor Index Fund. This index still looks at the Top 40 companies, but instead of simply distributing your investment equally amongst them, it now uses 6 factors to find the best investment weighting; size, momentum, volatility, value, low investment and high profitability.

In theory this is much better and one can use a lot of automation (or AI) to create the best investment strategy. But, this new approached diverges from a standard passive investing approach as this is now semi-actively managed. Many fans of passive investing are running for the hills whilst others (like me) are cautiously standing on the sidelines.

I don’t really know what to do. For now though, I’ll stick with the CoreShares Sci-Beta approach and see how things go.

My new investment strategy

I don’t want to do anything too drastic so I’ll keep reading and keep tracking my investments but when I next invest I’ll realign my portfolio to implement some minor changes.

30%25% Local Equities – CoreShares Sci-Beta10%15% Local Equities – Satrix Top 40- 10% Local Property – Satrix Property ETF

- 40% Offshore Equities – Satrix Worldwide

- 10% Offshore Property – Sygnia Global Property ETF

I’m reducing my investment in the CoreShares Sci-Beta fund and will probably reduce it more in the coming months. I’m also strongly considering adding a small percentage of a Top50 fund or an emerging markets but I am also aware of over-complicating life. So for now I’ll stick to the above.

In closing

Passive investing has proven it’s value over the long run and it’s eay to get caught up in the details and trying to “win” at the game by over-diversifying. One needs to keep things simple and just keep making monthly investments.

Patience is what counts most!

Previous updates

I won’t list them all, but the past 3 updates were:

Invest in ETF’s – My June 2019 update

How does political instability affect investment? (May 2019)

Are ETF good investments? April 2019 was a really good month for me!

Personally I find smart beta funds an interesting read but intimidating. I’d rather stay with something I know and know well. So I have allocated 1% of my SA equity allocation to SMART. Same with DIVTRX and STXMMT. Of these 3 the most promising is STXMMT, but I have had a few mistrades with STXMMT so I hestitate to increase my allocation just yet. Follow my blog at http://www.gigabucks.co.za for more tips and articles on ETF investing.

Cool. Thanks for your input and I’ll definitely check out your blog