I invest in ETFs and decided to track and post my investment details for a year. We’re a few months in now and although my ETF investment is rather small, here’s the update.

I use the EasyEquities platform because I find them the cheapest. If you want to follow my full story, here are the previous months updates.

- My first investment with EasyEquities (Feb 2019)

- My ETF investment strategy (Mar 2019)

- Are ETF good investments? (I had a 28% growth in Apr 2019)

- How political instability affects investments (my 22% drop in May 2019)

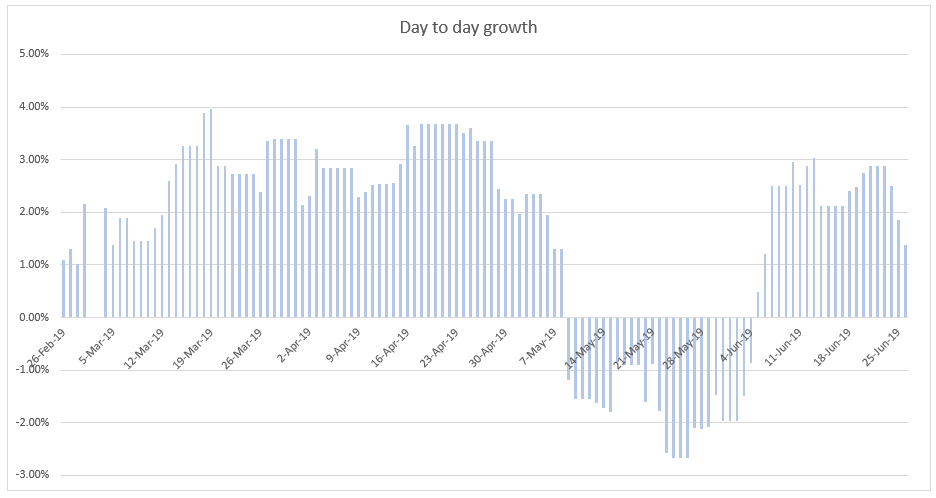

Daily fluctuation

When you invest in ETFs you’ll see that the prices and values change daily. It’s a little excessive (and maybe pointless) to track it. But, I’m finding it interesting.

Looking at the growth per day on my overall investments you get the above graph. Everything was going really well until the elections when things tanked. But, the investments are growing again and I’m keen to see this in a few months time again. This is not compounded growth, it’s just day to day growth. If that sounds confusing than just note that it goes up and down; drastically sometimes! LOL

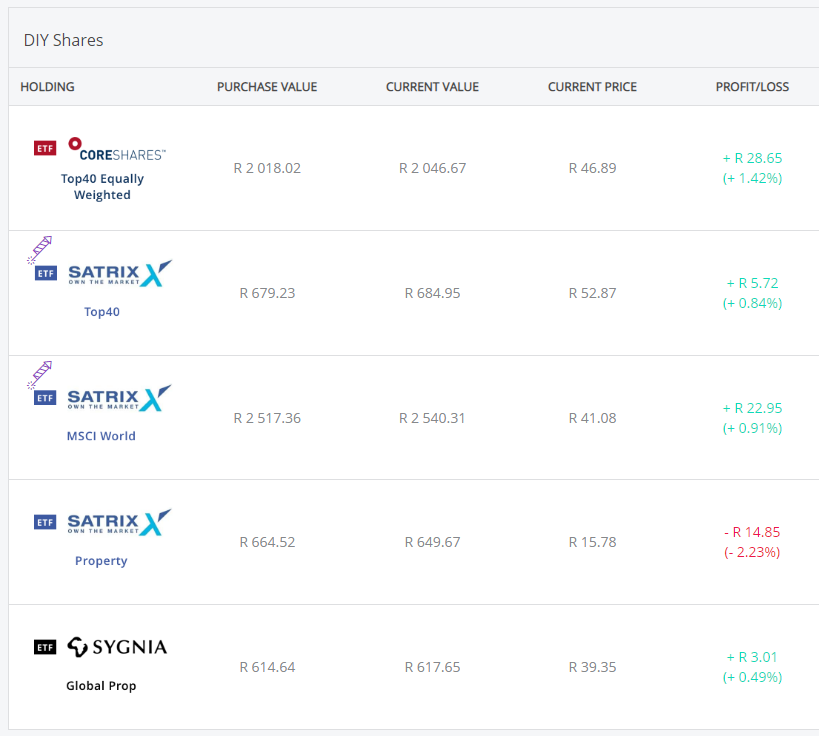

What’s my ETF investment looking like now?

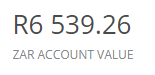

As at 26 June 2019 the total money invested is R6,450 and the current investment value is R6,539.26 – a growth in time of R89.26. Now I know that this seems dismal and barely worth mentioning, but there’s a financial principle at play here namely interest.

Looking at the actual amounts invested, along with the number of days invested, you’ll see that I’m averaging 7% which is a little more what my bank gives me. There are fixed deposit accounts and other savings accounts that will give you a better return, but passive investing (investing in things like ETFs) has proven to be the best over a 30 – 40 year term. Looking at it in that light it really is pointless tracking it each month but I would like to share my emotions, experiences and even mistakes along the way.

In April I had calculated my average return as 28% and then last month the average return using this calculation was -22%. So it is averaging out and it’s becoming more and more evident why this is meant as a long-term investment. Imagine depositing money in “month 1” and then suddenly needing to withdraw it a few months later when you’ve actually lost money. That would be terrible!

My investment strategy and shares still remain the same and I managed to invest and extra R400 this month. I would prefer to have invested more but I’m also paying off my home loan early, doing the 52 Week Savings Challenge and generally dealing with life which can sometimes have its challenges.

Why invest in ETFs?

So here’s the question I often get asked. Why invest in ETFs? Are they really worth it?

The short answer is “yes”. And the longer answer is also yes (LOL).

If you simply invest R20,000 into an ETF (eg Satrix MSCI World) now and wait 20 years you would probably make a fairly good return. It’s hard to estimate exactly what it would be as we can’t read the future. But almost certainly it would be better than what you would get in any fixed deposit or super savings account at a bank. And if you also reinvest the dividends you’ll be looking even better!

However, one of the tricks to ETF investing is to invest as much as you can as often as you can. You don’t need to try and predict the markets or do the whole “buy low sell high” thing. Just buy as much as you can, when you can. This means that you will over time get some good deals where you happen to time the market well, and you’ll get some not-so-good deals. But each investment will be growing and you’ll probably outperform most managed funds as the fees are so low and your investments are inherently diversified.

And what about when you need the money? Well, withdraw as little as you can as seldom as possible. Doing this will help maximise the potential growth on your investments!

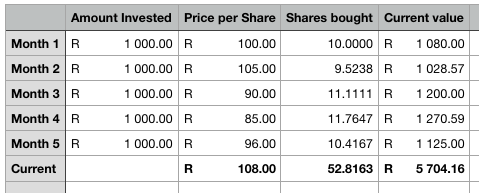

An example of ETF price avergaing

Let’s say you invest R1,000 in an ETF (any one) in Month 1 at R100 per share. Then in month 2 you invest another R1,000 but this time at R105 a share (as the share price increased). And then in month 3 you invest R1,000 at R90 a share, and so on.

In this example the shares that you bought in Month 4 (at the lowest price) will show the most growth. Or another way to look at it is that you could buy more shares in the months where it is cheaper. So imagine if a share costs R100 today, what would it be worth in 20 years time?

The nice thing about ETFs is that they are a collection of shares and nicely diversified. (See more on what are ETFs)

Now you don’t need to track individual transactions, but this is the principle. Each time you invest you’re buying an amount of stock. Sometimes you’ll get it for a good price and sometimes not. But as long as you keep it, it doesn’t matter if the value goes up or down. Just keep it for as long as you can!