It’s easy to open a new investment account either by a “self-service” type of method where you select your investment based on your own research, or via a broker. Fees however play a vital role and should be considered as a strong factor when making your decision. So how do investment fees work? Well, read on.

Listen to my live chat on Cape Talk radio about what investment fees are.

Why I’m writing about investment fees

A work colleague who wants to invest some money into a Tax Free Savings Account (TFSA) recently received a quote for his investment with the following fees.

My initial reaction was one of shock and horror as I thought that the annual fees in the first year were in fact 21.5%! It’s easy to make this mistake though as the table is not very clear. After posting about this on Twitter I found out that I was actually reading this incorrectly and that the fees listed in the first 3 columns are only applicable should you cancel your investment within the years specified. In this case only the fees in the final column are applicable (provided you don’t cancel or move your investment).

This doesn’t necessarily make it better as one should be able to change your investment choice without such steep penalties, but that is a whole different discussion but certainly something to be conscious of when opening a new investment account!

Imagine a 21% “penalty” for moving your investment after a year? That is shocking!

So let’s look at what investment fees are, how investment fees work, and what to look out for.

What are investment fees?

Every investment will incur some sort of investment fee. It’s only fair that the providers who create and administer your investments can get paid. In fact, even companies that offer websites and apps through which you invest in your own choices need to be paid. Such IT systems don’t come cheaply.

Investment fees are percentage based and if the fee is 1% and you have R100,000 invested; you will pay R1,000 per year in fees. If the fee is 2% you would pay R2,000 per year in fees. Get the picture? And now think about an investment worth R10 million – what would those fees be?

Once you lump everyones investments together and look at the percentage based fee you’ll start to see how much money financial institutions make off us! Imagine a fund administrator who administers a combined investment of R50 million (ie all their clients money together). If they charge a 3% fee per month they would be taking R1.5 million each month.

They obviously have to pay for operational expenses, salaries, etc, but then again, most investment houses manage far larger combined investments (in the hundreds of millions) and draw far larger monthly amounts!

The bottom line is that we do need to pay for the services as someone has to do the admin, manage our transactions, give us reports and statements, tax certificates and generally comply with the law. That costs money.

How do fees affect my investment?

It’s important to note though that investment fees eat away our profits over time, especially over a long time (say 10 years or more).

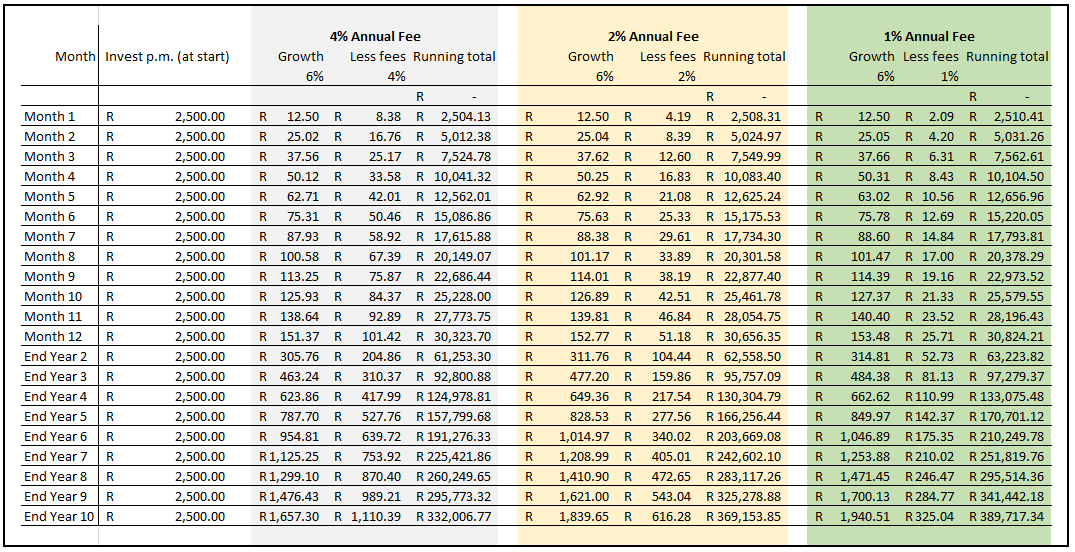

Here is a very basic example of investing R2,500 at the beginning of each month and the money grows at only 6%. We’ll compare the exact same growth with a 4%, 2% and 1% fee.

It’s important to note that no provider can offer you guarantied returns so an advisor cannot tell you that the higher fee they’re suggesting is worth it because your money will grow more. However some providers do manage better returns over time.

You may need to click on the image to see a larger view but after 12 months the “running total” column differ by only a few hundred rand and doesn’t seem significant. However, after 5 years the difference between a 4% fee and a 1% fee is over R12,000! Now that’s a big difference!

After 10 years the difference between a 4% fee and a 1% fee is R57,000! Wow!!! Now imagine after 20 years or even 30 years what a difference that makes!

What should I look out for?

The important things to understand how investment fees work. When looking at a fund fact sheet or when reading a quotation that is sent to you, ask:

- What is the effective annual fee? (The combined fees per year)

- Does the fee increase when your fund performs better? (is there a variable element?)

- What (if any) are the cancelation / change penalties?

Don’t be afraid to ask questions and get a good understanding of everything as you are never under any obligation to sign up for anything.

Also note that there are providers who can offer you fantastic products with fees less than 1% !

What are ETF’s?

ETF’s (Exchange Traded Funds) are seldom suggested by your financial advisor as these seem boring and grow too slowly. And of course the fees are usually very low which means that there’s nothing in it for them.

However, ETF’s over the long term (20+ years) will really grow your money and because of the super low fees you may possibly even be in a better position than if you use traditional service providers and products.

Have a look at what ETF’s are and do your own research.

If you are new to investing

Take your time to get started – rather spend a month or two and make a sound decision

Don’t be afraid to ask for different opinions – speak to people you trust and see what they do themselves

Educate yourself – read blogs, speak to financial advisors, watch online videos

Read some of these posts

- How to start investing

- How to read fund fact sheets

- What are ETF’s

- My first investment with EasyEquities

This is your money so make sure that you do the best with it!

Investment fees extremely important in growing your financial wealth.

Great article. I’m almost finished reading “Little Book of Common Sense Investing” by Bogle and he speaks about fees a lot, it never really clicked in my head the effect fees has on the long-term until he laid it out with simple math, and now example only further helps.

I’ve been researching quite a bit and it seems really hard to find passive funds (and thus much lower fees that come associated with the active managed funds) in ZA

It is amazing what effect the fees have! We have around 70 ETFs in SA but one does have to research regarding the fees. And have you heard of EasyEquities? You can follow my monthly ETF update and see what I’m doing.

I have opened up a saving goal with Tyme bank. It is a good competitor with Capitec bank (fees, etc), over Over 2 weeks, saving R10 000, I have made R20 from interest accrued. You get 6% saving over a month, 7% over 60 days and 9% over 90 days…

I have now raised my savings to R20 000 on this goal to see how it will perform over 6 months.

What are your thoughts on this /

It’s a great place for short term savings with zero risk. And it’s great interest!