This is a follow up from my first investment with Easy Equities. An account of my personal experiences with my investment and my own ETF investment strategy and findings. This shouldn’t be taken as advice and it’s not being sponsored by EasyEquities, they just happen to be the platform I have chosen. You can of course use any platform and if you have something that you already pay for in your banking fee “package” then it’s probably good to just stick with that.

When ending off my previous post on 24 Feb 2019 my investment stood at R776.86 and I then invested another R500 two days later.

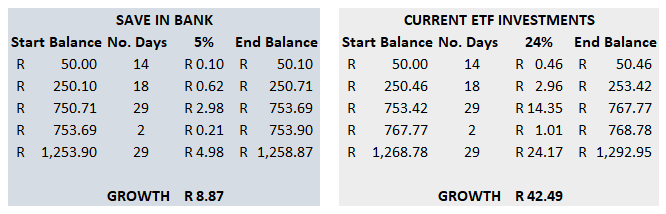

My actual capital invested (my money) is R1,250 and the balance of my investments is R1292.44 meaning that it has grown by R42.55. I’m not taking fees into account right now as that confuses matters a little and I’m actually more interested in the overall fact of how much money I have transferred into my investment (even if some of it went towards fees) and how much that money is worth now.

Changes to my ETF investment strategy

A very insightful comment that I received on Twitter was that a new investor shouldn’t get too hung up on sticking to an investment strategy in the first few months. It’s almost guaranteed that you will either make a bad choice or simply learn about new and better ideas. Also, if you’re willing to put in the time and effort to read blogs, books and articles on the matter you will inevitably change you mind a bit and come up with a strategy which you’re comfortable with. So, don’t over-stress.

Changing your mind is fine and acting on new information is really important! However, acting only on emotions or hearsay is not a good idea.

How it started

My journey started off with me simply purchasing some ETF’s and having no clue what I was doing. And when I published my last post I had the following investments.

I had decided that I would like to rather realign my investments to stick to the following percentages between local & offshore equity & property.

- 35% Local Equities CoreShares Equally Weighted Top 40

- 5% Local Equities Ashburton Top 40

- 10% Local Property – Satrix Property ETF

- 40% Offshore Equities – Satrix Worldwide

- 10% Offshore Property – Sygnia Global Property ETF

How it ended up

However, after publishing that I had many comments, suggestions and questions which got me reading and thinking and I have only made a small tweak so far.

I realise that Satrix Top 40 is cheaper (I had read the wrong fact sheet), and I have also read some articles on the proposed changes to the CoreShares Equally Weighted ETF. But for right now I’ll stick to what I have.

I’ve also learned about the Top 50 index as well as the Ashburton MidCap ETF which both look interesting and are on my radar. Again though I decided for this month to stick to what I have and take my time about making these decisions.

I did however make a small tweak to my ETF investment strategy and have ended off with the following:

- 20% Local Equities CoreShares Equally Weighted Top 40

- 20% Local Equities Ashburton Top 40

- 10% Local Property – Satrix Property ETF

- 40% Offshore Equities – Satrix Worldwide

- 10% Offshore Property – Sygnia Global Property ETF

I am also wary of over-diversifying and splitting my money up too much. My investment is still so small that I don’t feel it’s worth taking every index and eventuality into account (if that makes sense). Maybe once I have a few thousand rand in my investment I might make a different decision.

Here are my current investments as at the end of 28 March 2019. Adding up the Purchase values don’t equal R1,250 as there have been fees taken off, I have sold & bought ETF’s and I also had a small dividend income that I invested. I’m not taking all these transactions into account as that just becomes way too confusing!

How has my ETF investment performed?

When showing this to my partner I got a very unenthusiastic grunt. What’s R42.55? Is that really worth getting excited about? Well no, R42.55 is hardly anything but it’s the principle that’s worth getting excited about!

I have done a calculation taking the money I invested and calculating the interest for the number of days invested. I initially calculated the daily compounding interest which is more accurate but a much more detailed calculation. For a small investment like mine the difference is really small!

Have a look at these results. If I placed my money in a bank account and earned 5% interest I would now have R1,258.87. But I have more than that and it works out to an average growth of 24%! That’s fantastic and something to get excited about!

But note: This is only calculated over a short period and is NOT indicative of how my investment will grow over the long term. So don’t simply jump on the bandwagon thinking that this is a “get rich quick” kind of thing as it really isn’t. My investments have performed well over the past 3 months but rather keep reading these posts and let’s see how it grows over a longer period. There will certainly be up’s and down’s and things will not always be rosy. That’s the mindset that you should take on when investing for the long-term!

Creating your own ETF investment strategy

It’s really interesting to learn about ETF’s and the underlying indexes or shares that they follow. And there are so many online resources, articles and opinion pieces that you really have no excuse about not knowing where to start. You kind of just need to take a little money and make a decision about where you would like to invest it and then make the time and effort to learn as much as you can.

You are allowed to change your opinion and decisions over time. In fact, I would encourage it! There is a great mantra that is used when working in “agile teams” and it’s simply:

Inspect and adapt

Now move on to see how my investment has performed in April 2019.

What happens when you decide to change your strategy, and you have to sell some of your ETF’s? What is the tax implication, is SARS going to consider your account for speculative trading, do you have to hold for 12,24,36 months before you sell?

Interesting question.

Short answer from Simon Brown

“short version is hold for 3 years for it to be CGT .. but SARS cares about intent (very hard to prove), but certainly intent/strategy does change and therefore if shorter period could still claim CGT .. just as long as it an infrequent event and not every few months”

Check out some other responses on the Tweet with your question

https://twitter.com/your_money_blog/status/1122236617530466304

Thank you Brendan