There are so many fees, taxes and costs involved when purchasing a property that it comes as a relief when the bank offers to add the home loan initiation fee on to the loan so that you don’t have to pay it upfront. What this means is that if you take out a home loan of R500,000 the bank will simply add the R5,700 (approximate) home loan fee to the loan.

It’s very tempting to do this and some banks don’t even give you a choice, they simply do it. But what is the true cost of this initiation fee?

Listen to the Cape Talk radio interview about the initiation fee for home loans.

What is the initiation fee? / Initiation fee meaning

The bond initiation fee is an administrative charge that the bank charges when opening the bond account. It’s not really needed as the financial institution is already making lots of money from you via the interest payments and monthly admin fees. This is just an additional upfront cost which they are allowed to charge, and thus do. It’s around R5,700 but can be different per institution.

The home loan initiation fee and interest

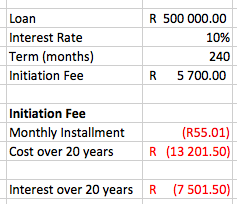

Let’s look at the following example:

A loan of R500,000 over 20 years at the current prime interest rate of 10%.

If you add a bond initiation fee of R5,700 to the loan and only pay the minimum installment each month over the 20 years this will end up costing you R13,202.40 which means that you will pay more than double the amount!

R7,501.40 is just interest that you are giving to the bank for the initiation fee! However, the monthly installment for this initiation fee is only R55.01. This is such a small amount which is why it seems so tempting to just add it to the loan payment. But it costs you over R7,000 for that convenience.

Pay the home loan initiation fee upfront and pay as though it was part of the loan

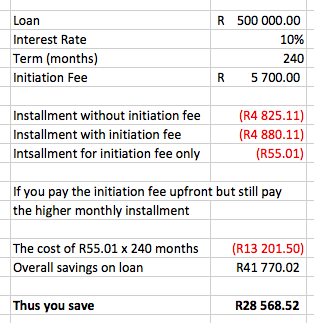

Okay, so this might sound tricky but the idea is that you pay R5,700 upfront for the bond initiation fee. Even if the bank insists on adding it to your loan, make a deposit to your loan account on the first day to make sure that it is paid.

Now, for the next 20 years pay R55.01 extra each month (as you would have done if the initiation fee was part of the loan). R55 is so little that you won’t even notice it, but it will make quite a difference after 19 years. In fact, you’ll end up paying the loan off almost 9 months earlier!

If you look at the calculation, the extra payments of R55.01 each month will end up costing you R13,201.50 over the 20 years but that will reduce the loan by R41,770.02 which means that your net savings is a whopping R28,568.52. This is just from a small monthly payment of R55.01.

See what a huge difference a small extra payment can make!

Another interesting factor to consider is that if you save money in your home loan you will earn interest at whatever your home loan interest rate is. In South Africa it’s roughly between 9.5% – 13%. That is a nice interest rate for short term savings and you pay no tax on the growth as it’s happening within a home loan.

TRY OUT THE ONLINE HOME LOAN CALCULATOR

How to do finance calculations in a spreadsheet

The easiest way to do these calculations is to use an Excel spreadsheet along with the PMT and FV formulas.

To calculate the monthly installment due on a loan you can use the PMT function.

Simply select the PMT function from the Financial formulas in Microsoft Excel and fill in the parameters as follows:

Rate – this is the interest rate per period for the loan. This means that if you are paying the loan monthly, then you need to take your annual interest rate of say 10% and divide it by 12 to get a monthly interest rate.

Nper – the number of payment periods. For our example we are paying the loan off over 20 years, hence 20 x 12 for number of months.

Pv – the present value of the loan – or the starting loan amount

That is all you need in most cases and you will see the answer is already calculated.

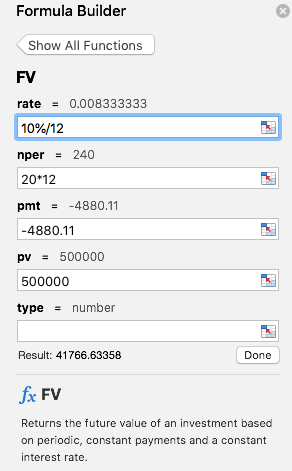

To calculate the savings when paying a higher installment you can use the FV function.

The FV formula takes similar inputs as the PMT formula. You can use this to either calculate the growth on an investment (see calculating the Future Value of an investment) or in this case we want to try calculate the savings if we pay extra into the loan.

The theory is simple, if we use the FV formula and add the exact installment into the PMT field then the Future Value of the loan after 20 years would be exactly zero.

That makes sense right because we are paying it off with the exact correct figure.

In the example though, we are paying a slightly higher installment and thus at the end of 20 years we actually have over R41,000 “positive” in the loan, meaning we have paid too much!

The screen-shot here does not exactly match the section showing the savings and in fact the amount saved is about R4 different. That is because I captured the figure of R4,880.11 as a payment when in fact it is slightly rounded. Referencing a cell which has the calculated installment figure will be more precise.

So the inputs required for the FV formula are:

Rate – this is the interest rate per period for the loan. This means that if you are paying the loan monthly, then you need to take your annual interest rate of say 10% and divide it by 12 to get a monthly interest rate.

Nper – the number of payment periods. For our example we are paying the loan off over 20 years, hence 20 x 12 for number of months.

Pmt – the installment you are paying each period. (This must have a “-” sign as it is a payment)

Pv – the present value of the loan – or the starting loan amount

If the result is negative then it means that your monthly payment is too little. If the result is zero then you are paying the exact correct amount and if the result is positive it means that you are paying too much and in reality it means that you will pay the bond sooner.

Conclusion

The calculations will never be 100% correct as you’ll change your payment from time to time and the interest rates may also change. There may also be additional monthly bank costs or other small changes beyond your control. You can however use this kind of logic to help plan and predict savings or costs.

Always be sure to ask about the bank initiation fee, understand the costs and options available to you. Also ask about costs and fees on mortgage bond and get all your ducks in a row. All part of the process to take charge of your money!

And the one-line summary of what is an initiation fee for home loans; the initiation fee definition? It’s the fee that financial institutions charge to open your loan account. This is over and above any other charges.

When using the home loan calculator, take a look at the difference when adding the home loan initiation fee to the deposit or to the loan amount.

1 comment