Fund Fact Sheets are not as complicated as you think. Let’s take a look at what fund facts sheets are, what they tell you, and how to read a fund fact sheet.

Fund fact sheets explained

Deciding where to invest your money can be a daunting task and it may seem that you’re not “qualified” enough to do it. Chances are that you have what it takes though and you don’t need to blindly follow the “experts” when deciding where to invest. Don’t get me wrong though, a Financial Advisor can be of great value, but you need to understand things yourself so that you can make informed decisions.

First things first, have a look at this post on how to start investing as this will give you a very high level overview of what type of savings you should consider for various goals you may have.

Please note that this blog only covers a few aspects of the fund fact sheets. Fact sheets can be found on investment managers websites and each fund should have it’s own section or downloadable file with all the details. This blog is looking at Unit Trust and Mutual Funds.

Choosing an investment manager

There are many investment management companies to choose from and there are a few factors to consider:

- How long have they been in business

- The brand and reputation

- Assets under management (how many millions)

- Costs involved (Why do investment fees matter?)

The fact that your Dad has used them for the last 35 years is not a good enough reason on it’s own!

All Investment Managers have the same goal in common; they want to make as much money as they can for themselves. They really just use you in order to enrich themselves so when selecting who to trust with your money you need to really consider how much you will be paying for their services.

In South Africa we have very good Consumer Protection laws and companies have to disclose all fees & costs upfront. This may not be the case in all countries and you need to ask very direct questions about all costs that are charged.

Although this may seem depressing, you should remember that no Investment Managers take responsibility for your money. They hide behind the “markets” and they can potentially lose a lot (if not all) your money should they make bad decisions. Personally I don’t invest all my money in standard investments, but that is for another blog post.

What is a fund fact sheet?

Each investment fund that is available for you to invest in will have it’s own Fund Fact Sheet. This is a short document explaining the funds purpose, risk, details and past performance. Although insightful, this is a marketing advert for the fund and thus you need to read between the lines and carefully consider all information (especially any fine print).

So how to read a fund fact sheet

There can be a lot of information on the sheet and below I’ve highlighted some of the important things to look out for.

Investment Term

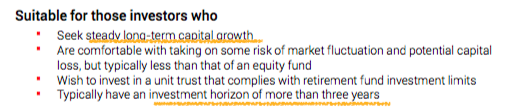

The investment term of the fund should match that of your goal. Are you investing for the short, medium or long term? Look out for the area which details this.

Risk Factor

This can be displayed very differently between various Fund Managers but generally speaking, longer term funds are higher risk than short term funds. This is not always true though as it also depends on the objective set out for the fund. Be sure to understand the Risk Factor associated with the fund as that is directly related to the potential loss of your capital!

Fees & Costs

A very important section to read is the fees & costs involved in administering your money. Most funds charge a fee equivalent to a percentage of your investment. Others may add additional clauses stating higher fees based on funds performance. And of course a big one to consider is the initiation fee. If this is a percentage of investment then you can essentially lose money before you even start!

Also be sure to understand whether the fees include or exclude any additional taxes (eg VAT) and find out what your advisors fee is as this may be influencing the advice.

Take note of the Total Expense Ratio (an average of actual expenses over a year). In this example the TER is 1.78% thus your investment of R100,000 would incur annual costs of R1,780. In this case tax is already included but transaction costs are estimated at 0.09% (or R90) giving you a total annual cost of R1,870.

It’s important to understand the effect of the costs versus the growth. Many people prefer index-based funds (passively managed) which incur far lower costs. Whatever you decide, take the time to research. Also look out for any penalty-type fees which may exist. Read about my first ETF investment with Easy Equities.

Average growth (historic)

This is always the part that catches peoples emotions. Seeing high performance is great and you obviously want to invest in funds that do well.

The unfortunate reality though is that nothing is guaranteed and past performance cannot be relied on. When viewing the fund stats look out for how many years the fund has existed and the performance since inception. See how this fund performed very well over the past year, but the average since inception gives a more sober view. I prefer funds which have consistently performed well over 10 or more years; but that is still no guarantee.

Underlying funds

The underlying funds or company portfolio will give you the details of which funds or companies you’re investing in. You can easily look for additional info on these.

Accompanying this info will also be a break-down of assets classes or industry allocation, depending on what is relevant. This relates to the overall risk factor.

Withdrawing your money

Very important to note is how one can access your money! Look out for any restrictive clauses or charges involved. If you’re not sure of anything just pick up the phone and find out.

Final words…

Financial Advisors can be very helpful and should play an important role in your financial planning. Don’t however take their word for everything and don’t blindly follow their advice! Do you own research and comparing of funds and ask questions, lots of questions!

At the end of the day you are responsible for your own money and your own future. Learn as much as you can and take charge of your money!

There is a lot of good and free information available on how to read a fund fact sheet so if this article wasn’t enough, do some searches and you’ll find plenty more.