Have you ever set a financial goal which you didn’t reach? You really aren’t alone because we live in a world fill of uncertainty and constant change. It might be easy enough to set short term manageable goal, but how on earth do you set a 20 or 30 year goal? In fact, is it even possible to make a retirement plan in uncertain times when you have no idea of what lies ahead?

Some concepts in this post are taken from a talk I heard at this years Agile Africa Conference. The talk was by Sonja Blignaut and titled “Enabling Adaptive Cultures from Agile to Agility”. So if you’re wondering how an “agile business” presentation has any relevance to finances, it’s simple, it’s just a mindset!

General direction

Goals are great for the manageable short term, maybe a year or two at most. But for any longer period your goals (whether you like it or not) simply become wishes as there are just too many unpredictable events that will happen between now and your future goal date. You can try to anticipate and plan for situations, but life happens and there are so many things beyond our control.

Another “problem” with a long term goal is that there are often more than one good scenario that are different but which would suite you fine.

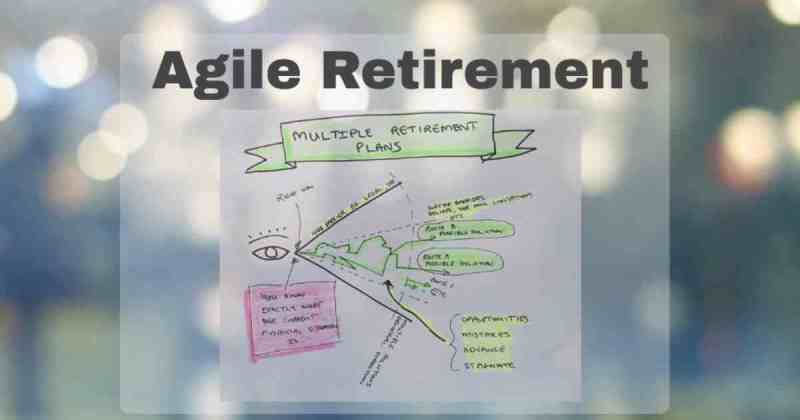

Multiple end-points

If you take Retirement Planning as an example, a goal might be to retire with R5 million by age of 65. However, as you grow older the economy may change drastically and you find that having R5 million is just not enough. But, if you had R5 million and a rental property then you would be okay. Or perhaps having less of a lump-sum but a larger monthly income would also suffice. And maybe right now you cannot imagine moving to a different town but as you grow older you may choose to move to a remote area which happens to be really cheap to live in and thus you don’t need the large retirement fund.

Perhaps priorities in life change and you decide to live frugally and give all your money to your grandchildren or you decide to go sailing. So many things could make you happy!

You see, there isn’t just one right solution to the problem but rather a set of possible outcomes which could work. So by only focusing on one solution you could easily miss out on a different opportunities and possible outcomes.

Instead of fixating on only one solution and being hard on yourself to reach your goals, a better approach would be to set an intention or general direction you would like to see yourself going and then assess your path often.

Your focus is to retire happy and comfortably. This can be defined in monetary terms but the exact details should remain flexible.

Knowing the boundaries

Along with your intention or general direction, one must be aware of the boundaries and limitations that exist.

There are some “hard” boundaries which may affect how much you can invest, how much tax you pay and what investment vehicles you can use. These legal boundaries and hard limits are things which you cannot change. If you’ve encountered such boundaries which have caused you frustration, list them as you’ll need to work within them.

There are also “softer” boundaries. These relate to how much you can physically work (hours and effort) and how much you can earn (this is part of a belief system but it’s a self-imposed boundary). Other “soft boundaries” include how much you can save, what you are prepared to spend on your budget, and how much you invest monthly. Such boundaries are not as rigid as the legal ones. You can work longer hours or change your beliefs about what you are worth and how much you can earn. You can change your budget to spend more or to save more.

Thinking about these boundaries can also be useful though when looking at your long-term intention.

Constant feedback loop

We’re bound to veer off a path sometimes, go backwards when life throws a curve-ball and sometimes we may stagnate. That’s ok, as long as we are constantly reflecting on where we are and where we want to get to.

The nice thing about fixed goals is that they are measurable in terms of time and achievement. You set specific goals with specific outcomes and you know exactly when you have reached them. When setting an intention or general direction it seems a bit “airy fairy” as to when you actually achieve you goal and it seems impossible to measure considering you could achieve it by various means.

This is when constant assessment and feedback comes in to play. Each day (month & year) you know more about yourself and your surroundings than the previous day. You know your health, your debt situation, family circumstances, current economic circumstances, investments, etc and you need to constantly assess your current situation and decide if you are still heading in the general right direction. Some circumstances may be short term measures that lead you to something better and you need to analyse your plans and the actions you’re taking and make the necessary adjustments.

Perhaps you can save more now, or perhaps you need to withdraw from your investments. These are tough decisions but looking at the bigger picture you need to decide if you’re still heading in the right direction; whether your current decision will indeed be the best for you.

Changing lanes

As you’re constantly assessing your situation and checking that you’re heading in the right direction, there is nothing wrong with changing lanes along the way. You can change your plans or your goals as you get to know more about your current circumstances.

As mentioned, life is unpredictable so as you learn more information it would most probably be a good idea to apply the new information to your plans and adapt as needed.

This does not mean that you switch funds and buy & sell shares; this is a “bigger picture” analogy about life, intentions and outcomes. We can be very hard on ourselves about sticking to a goal that we set months or years ago when in fact circumstances have changed and the goal is either unachievable now or perhaps it’s pointless as you’ve decided on a slightly different direction.

Be open to change.

Your retirement plan in uncertain times

Your best plans right now are bound to fail; you just don’t have enough information. You don’t know your future health, family situation, work situation, economic climate, country policies & laws, etc etc etc

The traditional retirement plan of having a single investment portfolio to sustain you through retirement is a great starting point but there is a good chance that it won’t work out as expected. Don’t rely on the plans you you set in place 5 years ago.

This shouldn’t stop you from making plans. Knowing that we don’t know it all should help you understand that you should assess your plans often and change them when needed! Being agile in your financial planning will help you see new opportunities and give you more confidence to change direction when it becomes clear that you are no longer heading the best way. You can still make a retirement plan in uncertain times, just anticipate change and adjust when new information presents itself.

An agile mindset is one which anticipates and encourages change.

My personal finance spreadsheet

I track all my finances on a spreadsheet.

- Assets

- Liabilities (debt)

- Net Worth

- Retirement Goals

- Investments

- Income

- Expenses

- Diversification

- Dividend income

You’re welcome to download the personal finance spreadsheet template and use it yourself.

Great post. Have been thinking along these lines lately also. There are many options in life. Which do I want to follow?